United Texas Credit Union

5500 Utsa Blvd, San Antonio, TX 78249

5500 Utsa Blvd, San Antonio, TX 78249

Reviews

05/12/2014

Provided by YP.comI've been with them since they were an employee credit union for a major financial services company. I agree in the past they were first class, but they have really gone downhill since. High fees for everything. Deposits take too long to clear. The website is ancient and unreliable and the app is a joke. Stay away, you're better off at a conventional bank or any other credit union.

10/01/2013

Provided by YPmobileI've been with this institution since it's beginning. At first they were better than every other place I looked at. Now I despise dealing with them. Charging for members to get money orders when other places don't is a big one. They make mistake on the money order, I'm supposed to not only pay the damn fee the first time but pay again because the inept teller made a mistake? The ONLY reason I haven't left yet is because of my auto loan. But the minute that is paid off, I'm closing my account and going somewhere else. Fair warning to anyone who reads this. Stay away from United S.A. Credit Union.

More Business Info

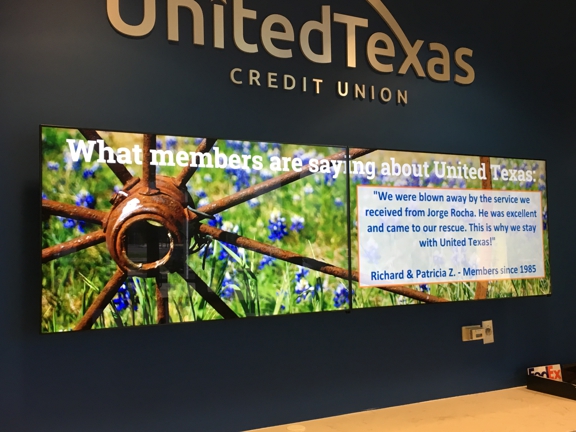

Friendly, Done Right.

- Business History

- From our start as the credit union for employees of the United Services Automobile Association (USAA) to now, United Texas Credit Union has been a member-owned, not-for-profit financial cooperative with the mission of improving the financial well-being of our members and the communities we serve. In April 1955, a group of 19 USAA employees each deposited $5.00 to start the credit union. After a short time, the credit union made its first loan of $85 to reupholster a sofa, which set the institution on a path to become self-sustaining. Growing Up Since then, we’ve gradually expanded our field of membership to include people who live, work, worship and go to school in Bexar, Kendall and Comal Counties and grown into a full-service financial institution with five locations, almost 20,000 members and approximately $240 million in assets. Even with our extraordinary growth, we continue to deliver friendly service, done right.

- Hours

- Regular Hours

Mon - Fri: Sat: Sun Closed - Logo

- Services/Products

- Gift Cards

- Mobile Wallets - Apple Pay, Google Pay, Samsung Pay

- Mobile Check Deposit

- Instant Issue Debit Cards

- Online Bill Pay

- Travel Cards

- Reloadable Prepaid Cards

- Consumer Loans - Auto, Unsecured, Credit Card, Boat, RV, Motorcycle, Home Equity, Mortgage

- Deposits - Savings, Checking, IRAs, Money Markets, Certificates, HSAs.

- Business Loans - SBA, Equipment, Vehicles, Real Estate, Rental Property, Credit Card, Line of Credit

- Brands

- mastercard

- Payment method

- check, cash, mastercard

- Neighborhood

- Northwest Side

- Languages

- English, Portuguese, Spanish

- Other Link

- Social Links

- Categories

- Banks, Credit Card Companies, Credit Unions, Financial Services, Internet Banking, Loans, Mortgages